7 Expert Tips for Meeting Escrow Analysis Requirements for Financial Transparency

As lenders, you will often find borrowers getting in touch with you about a change in monthly escrow payments after an annual escrow analysis. They often do not understand what brought it on and why their payments were going to change. This can cause significant stress for the borrowers.

In fact, in 2023, 56% of homeowners revealed that their escrow payments had increased and that it came as an unwelcome surprise.

Now, in such cases, lenders have no choice but to impose the revised payments. However, what they can ensure is complete transparency before, during and after the escrow analysis process to prevent borrowers from any stress. Result? Enhanced borrower satisfaction as they get time to plan their budget and accommodate any changes in their escrow payments.

Wondering how to ensure complete transparency and conducting accurate escrow analysis? Well, that’s what we will disclose here. Consider this blog as your faithful guide for all things escrow. Intrigued? Let’s begin!

Annual escrow analysis is a routine assessment conducted by every mortgage lender. It is done to review the status of borrowers’ escrow accounts. Escrow accounts are established to hold funds designated for property-related expenses such as property taxes, homeowners insurance, and, in some cases, mortgage insurance or homeowners association fees.

During the annual escrow analysis, you will evaluate the projected expenses for the upcoming year, including property taxes and insurance premiums. These expenses are compared to the balance in the escrow account to ensure that there are enough funds to cover the anticipated costs.

If the analysis reveals a shortfall in the escrow account, you will have to adjust the borrower’s monthly mortgage payments to ensure that there are adequate funds available. This adjustment helps prevent any potential shortages in the escrow account and ensures that all property-related expenses are covered timely.

When performing an annual escrow analysis, you must include the following to ensure financial transparency:

As a lender, ensuring the responsible management of borrowers’ escrow accounts is crucial. Annual escrow analysis serves as a vital tool for achieving this goal. Let’s under why it is important and how it is effectively conducted:

By accurately projecting and managing property-related expenses such as property taxes and homeowners insurance premiums, lenders can help borrowers maintain stable and predictable monthly mortgage payments. This stability is essential for borrowers as it allows them to plan their budgets effectively and avoid financial strain.

For lenders, ensuring financial stability among borrowers reduces the risk of delinquencies or defaults, ultimately safeguarding the health of their mortgage portfolios.

Annual escrow analysis provides borrowers with a clear understanding of how their escrow funds are managed and allocated. Through the analysis process, borrowers receive detailed statements outlining projected expenses, account balances, and any adjustments to their monthly mortgage payments.

This transparency empowers borrowers to make informed financial decisions, plan for future expenses, and understand the factors influencing changes in their mortgage payments.

Moreover, by fostering transparency in escrow management practices, lenders enhance trust and credibility with borrowers, contributing to positive relationships and customer satisfaction.

Escrow accounts are designed to hold funds for property-related expenses, and it’s crucial to ensure that these accounts have sufficient funds to cover upcoming payments. If there is a shortage in the escrow account, borrowers may struggle to make timely payments for property taxes or insurance premiums, potentially leading to penalties or even foreclosure in extreme cases.

On the other hand, if there is a surplus in the escrow account, borrowers may be paying more than necessary each month, leading to unnecessary financial strain.

By conducting annual escrow analysis, lenders can accurately assess the projected expenses and adjust borrowers’ monthly payments accordingly, thereby preventing both shortages and surpluses in escrow accounts.

Annual escrow analysis is mandated by various regulatory authorities to ensure compliance with laws and regulations governing mortgage lending and servicing. These regulations require lenders to conduct annual reviews of escrow accounts and provide borrowers with statements detailing the results of these analyses.

Additionally, regulations may dictate specific practices or procedures that lenders must follow when conducting escrow analyses to ensure transparency and fairness. By adhering to regulatory requirements, lenders demonstrate their commitment to ethical and responsible lending practices, building trust with borrowers and regulatory agencies alike.

Conducting annual escrow analysis entails the following five steps:

The first step involves collecting all the necessary documentation to paint a clear picture of the escrow account’s activity. This includes:

Accuracy is paramount. This step involves meticulously comparing your records with those of the financial institution. Ensure:

Now it’s time to analyze the year’s transactions. Here’s what you’ll be looking at:

Having enough cushion is crucial. This step involves analyzing the current escrow reserve balance to determine if it’s sufficient for upcoming tax and insurance bills:

Based on the future expenses and cushion amount, calculate the new annual escrow payment for the borrower. Additionally, divide the new amount into the number of payments the borrower makes annual.

Transparency is key. Ensure all disbursements made from the escrow account are supported by proper documentation. This typically includes:

When conducting an escrow analysis, it’s essential to recognize that each borrower’s escrow account is unique, reflecting their individual property taxes, insurance premiums, and potentially other expenses.

Depending on the loan agreement and property type, there may be additional expenses included in the escrow account, such as mortgage insurance, flood insurance, or homeowners association fees. Identifying and understanding these additional components ensures comprehensive analysis and transparency in financial planning.

Beyond standard escrow components, you should consider any unique circumstances or preferences specific to individual borrowers. For example, borrowers may opt to pay certain expenses directly rather than through escrow, impacting the analysis process. Understanding these nuances allows lenders to tailor their approach to each borrower’s needs and preferences.

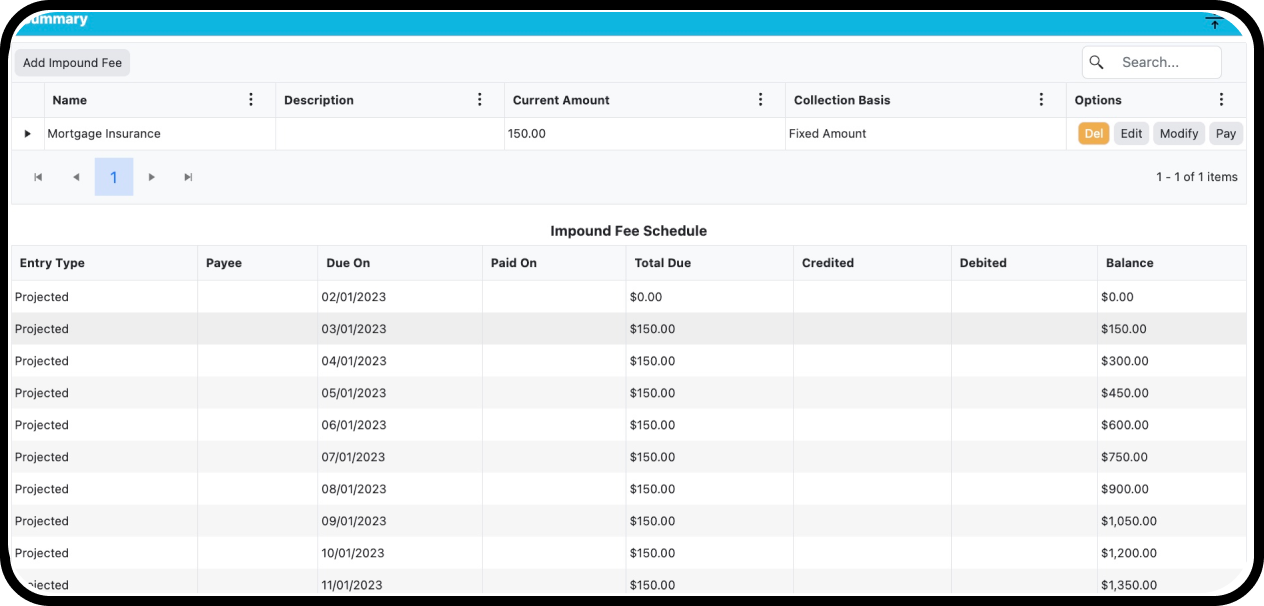

Maintain meticulous records for every transaction. This includes deposits, disbursements, fees, and supporting documentation (invoices, receipts). Consider using specialized escrow accounting software for ease and accuracy.

You can implement it through the following ways:

| Expert Tip! Utilizing Escrow Management Software Escrow management software automates many aspects of the documentation process, saving time and reducing manual effort. It eliminates the need for manual data entry, paper-based record-keeping, and repetitive administrative tasks, allowing lenders to focus on core activities. The software provides a centralized repository for storing all documentation related to escrow accounts. This facilitates easy access to records and documents, improving collaboration among team members and ensuring compliance with regulatory requirements. |

One of the most important ways to ensure financial transparency in escrow analysis is to proactively reach out to the borrower before you conduct the analysis. Transparency breeds trust, so informing borrowers beforehand fosters a collaborative and informed approach to financial management.

Whether you are conducting annual or bi-annual analysis, ensure that you have informed the borrower well in advance so the borrower can expect a change in their monthly payments.

Additionally, provide borrowers with a clear explanation of the escrow analysis process. This includes outlining the factors considered during the analysis, such as property taxes, insurance premiums, and other escrow-related expenses.

If the escrow analysis results in changes to the borrower’s monthly mortgage payments or escrow account balance, transparently communicate these changes. Clearly explain the reasons behind the adjustments and how they were calculated.

Pro tip: Keep a channel open for borrowers to contact you in case of any questions or concerns regarding their escrow analysis statement. This creates a sense of satisfaction with the borrower that you are just a call (or email) away.

When conducting an escrow analysis, errors or discrepancies may occasionally arise. These errors could stem from various factors such as incorrect data input, miscalculations, or unexpected changes in expenses. Promptly addressing these errors is crucial to maintaining transparency and trust in the escrow management process.

Here’s what to do when errors occur:

Regulations governing escrow account management are subject to change. It’s imperative for lenders to stay informed and abreast of these regulatory updates to ensure compliance and maintain transparency in their escrow analysis processes.

Regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) and housing finance agencies regularly issue guidelines and regulations concerning escrow account management. These regulations are designed to protect borrowers’ interests, promote fairness, and uphold transparency in financial transactions.

You can also benefit from engaging with industry associations, attending relevant conferences, and leveraging educational resources provided by regulatory agencies. These resources offer valuable insights into regulatory developments and best practices in escrow account management.

Today, automation plays a pivotal role in streamlining processes and enhancing accuracy in the finance industry. Leveraging escrow management software with built-in automation tools can significantly improve the accuracy of calculations and analysis. Here’s how:

Engage with financial professionals such as accountants, auditors, or financial analysts who specialize in escrow management or mortgage servicing. These experts possess in-depth knowledge of financial regulations, industry best practices, and analytical techniques, providing valuable guidance and validation for the escrow analysis process.

They can also review the methodologies used for calculating projected expenses, assessing escrow account balances, and determining adjustments to mortgage payments. Their expertise can ensure that the analysis is conducted accurately and in accordance with industry standards.

Also, having financial experts review the escrow analysis process adds an extra layer of quality assurance. Their scrutiny can help identify any gaps or errors in the analysis, ensuring that borrowers receive accurate and transparent information about their escrow accounts.

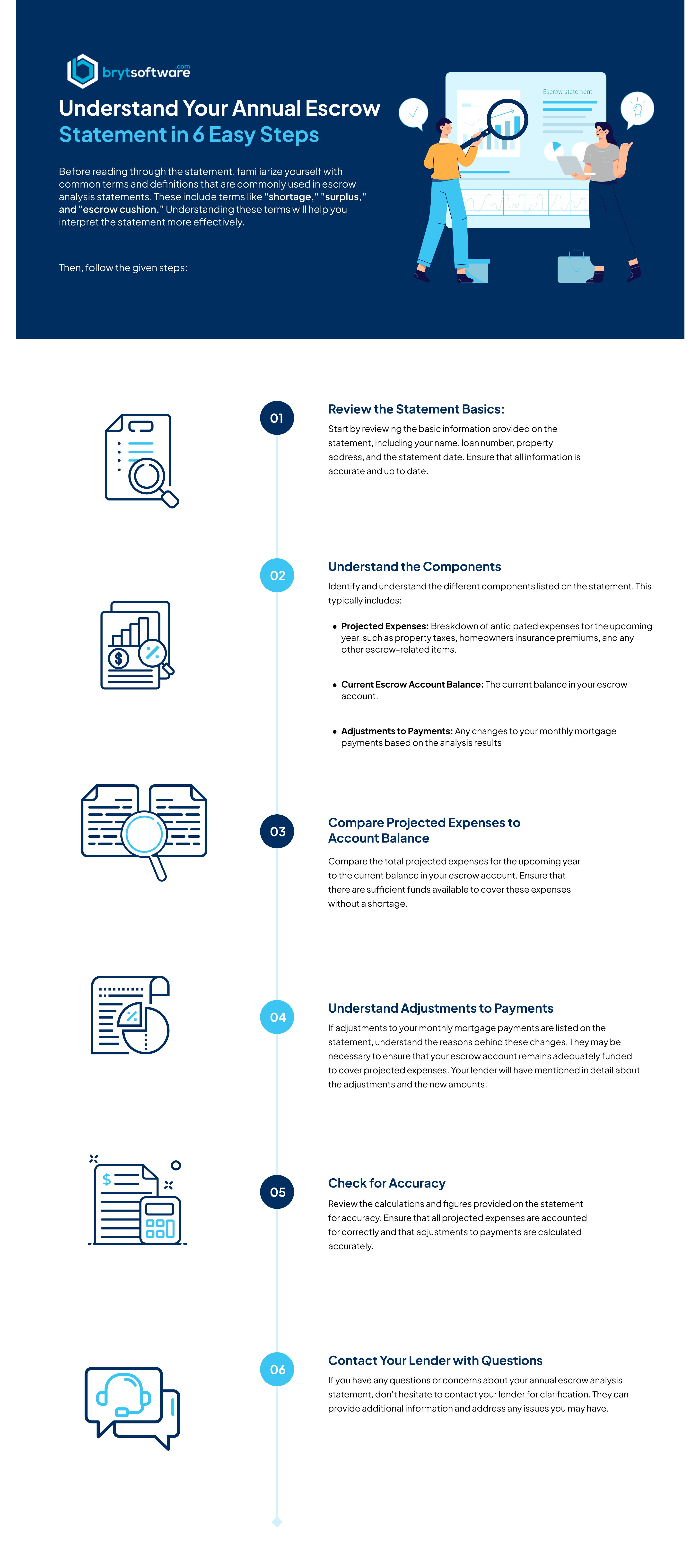

Did you know that about 48% of homeowners don’t understand how their mortgage escrow account works? This is not surprising given the complexity of the process and lenders’ inability to communicate the ins and outs of the process thoroughly.

So, here we have a quick infographic that will help borrowers understand their annual escrow analysis statements.

Pro Tip: Use the information from the analysis to plan for upcoming expenses and budget accordingly. Knowing the projected expenses for the year can help you prepare financially and avoid any surprises.

Annual escrow analysis can be a time-consuming and error-prone process, that is, when done manually. But no more! With Bryt automated escrow loan management software, you can streamline the process, boost accuracy and free up valuable time.

Ready to take the leap from manual to automated workflows? Bryt is here to help. Try Bryt Software for free or schedule a personalized demo, the choice is yours!

© 2024 Bryt Software LCC. All Rights Reserved.