Bring 5x Operational Excellence In Consumer Lending Services with Bryt

Choose from 20+ tailored loan products with Bryt. Generate new revenue streams through a fully automated system.

Choose from 20+ tailored loan products with Bryt. Generate new revenue streams through a fully automated system.

Handle increased loan volumes seamlessly with Bryt’s bank loan management system. Enjoy faster loan processing, greater data visibility, 24/7 access to loan documents, and one-click report generation - all from a single, uniform platform.

Get Started Now!

Unlimited Customized Loan Solutions

Unlimited Customized Loan Solutions In consumer lending, there is no one-size-fits-all solution. Bryt Software empowers you with limitless customization. Tailor your loans precisely to your clients' needs, ensuring unparalleled flexibility in your lending portfolio.

Contact Relationship Management (CRM)

Contact Relationship Management (CRM) Deliver unparalleled customer experiences. Bryt Software offers you the tools to manage an unlimited number of contacts effortlessly. Build stronger connections with your clients by uploading and storing documents, notes, and files - all while resolving even the most intricate loan issues within minutes.

Automated Loan

Automated LoanBid farewell to the complexities of loan management. Bryt’s Loan Creation Wizard is your trusted ally, streamlining your day-to-day loan servicing tasks. Payments, accruals, write-offs, and client communication become seamless, empowering you to keep a tab on everything while you concentrate on core tasks.

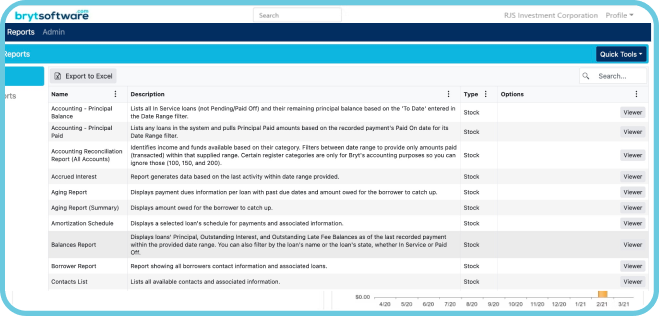

Built-in Reporting & Documentation

Built-in Reporting & Documentation Access detailed reports, including 1098 & 1099 generation, payment registration, and consolidated payments, at your fingertips. Gain valuable insights into principal balances, late payments, and historic weighted interest. Besides, our robust file management system keeps your focus squarely on revenue growth and security.

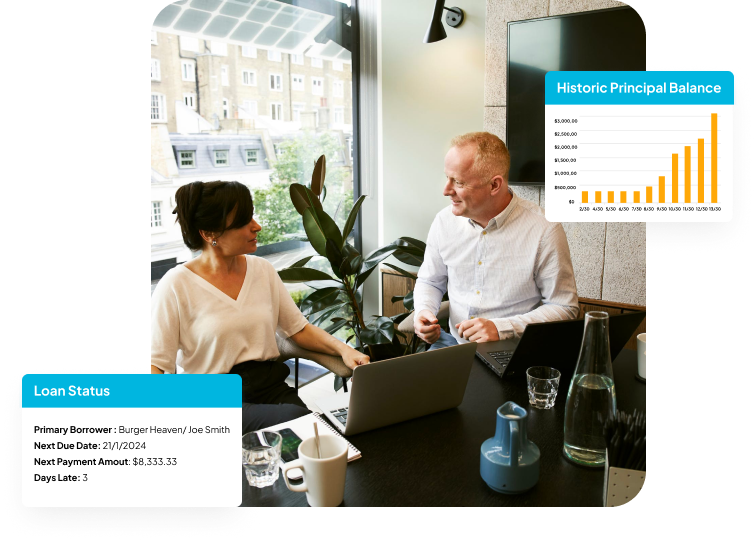

Advanced Loan

Advanced LoanData is your goldmine, and Bryt Software's advanced customization and configuration options unlock its full potential. Enhanced data visualization and transparency empower you to manage your portfolio more efficiently, giving you the insights to make data-driven decisions swiftly.

Regular Payment

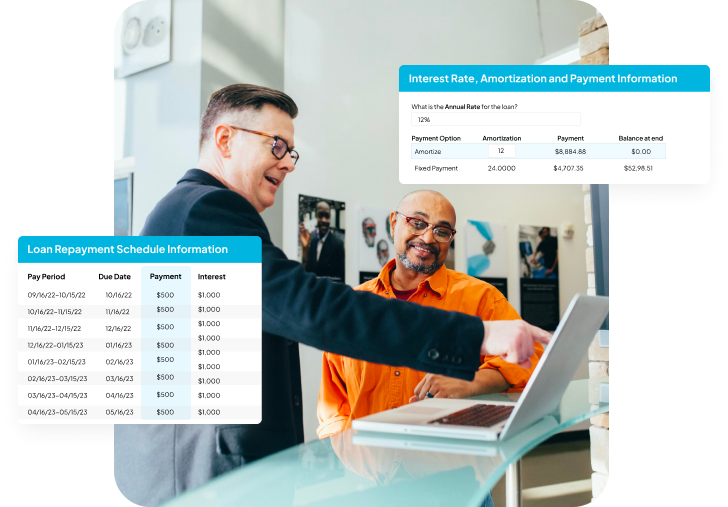

Regular PaymentSecure more loans with less effort, thanks to Bryt Software's predefined payment rules that allocate payments to various categories like principal, interest, and late fees. Optimize your collection system and boost ROI with flexible interest accrual methods

Get a 45-day free trial - no hidden terms.

Our commitment to ease of use is a game-changer. Imagine learning how to use a feature in one area and effortlessly applying it across the entire platform. It's that simple with Bryt. No more navigating complex systems; our interface is designed for seamless usability.

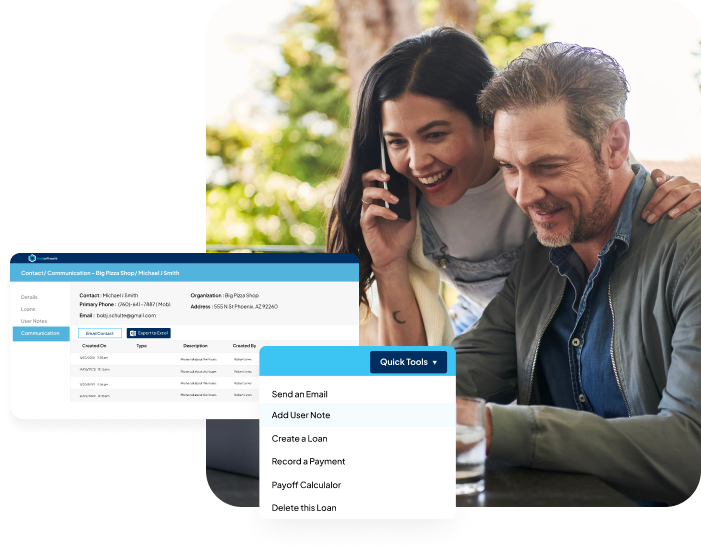

Time is money, and Bryt saves you both. Our Quick Tools are your shortcuts to common functions. Send an email, add a contact, create an activity record, delete a record, initiate a loan, or calculate a payoff - all at your fingertips. Efficiency has never been this accessible.

Manage more than just property taxes and insurance premiums. With Bryt, you can create an unlimited number of impound accounts, collecting any obligation on behalf of borrowers. Regulations evolve, and so can your impound accounts within Bryt's ecosystem. Modify accounts throughout the loan lifecycle, ensuring compliance and flexibility.

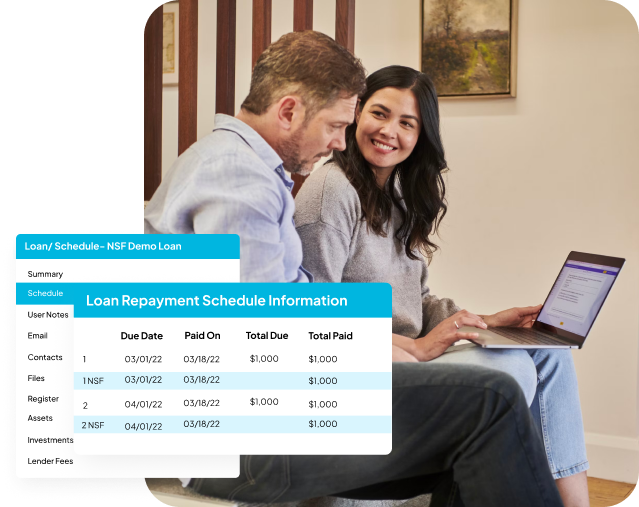

When a payment falls short due to insufficient funds in a borrower's account, Bryt Software's NSF (Non-Sufficient Funds) functionality serves as a reliable safety net. Bryt Software marks it as an 'NSF Notice.' No funds move at this stage; it's simply a notification to keep lenders informed.

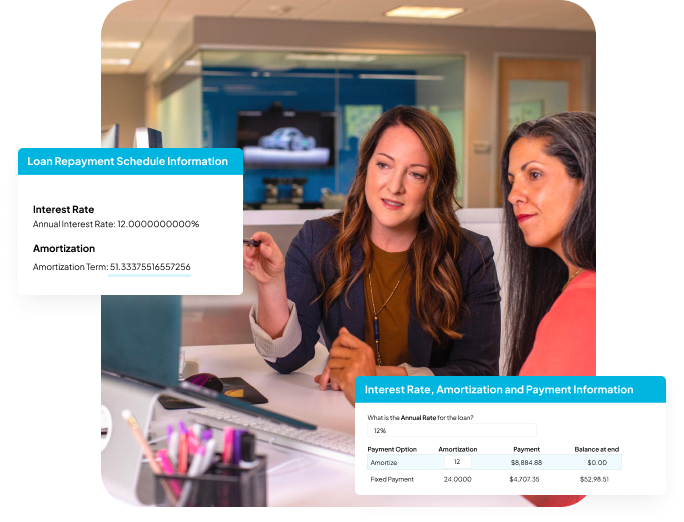

With Bryt Software, businesses can bid farewell to financial surprises. Amortization ensures loans are paid off over time in equal, manageable installments. Each payment comprises two essential elements. A portion chips away at the loan's principal, representing the original borrowed amount. The other part covers interest, representing the cost of borrowing.

We at Bryt understand that traditional passwords can be vulnerable due to various factors like password reuse, social engineering, or leaked databases. That's why it allows you to employ Two-Factor Authentication (2FA).

Bryt’s consumer lending software stores our data using Azure SQL, leveraging its features to enhance security. Point-In-Time Restore allows databases to be rolled back to a prior state within the last 35 days. Additionally, all databases benefit from redundancy in Azure's West US datacenter, guaranteeing uptime with a 99.95% SLA.

Bryt Software takes data protection seriously and has contingency plans in place to avert potential scenarios. It employs Azure's Application Insights to identify and address website and database availability issues, ensuring your operations run smoothly.

In the event of accidental data loss in consumer lending services mishandling by an administrator, Bryt utilizes Azure's point-in-time restore capabilities to revert the data to a previously known good state. Regularly, it restores a cloud-hosted database to a local machine and rigorously tests it using a local copy of the Bryt Application to ensure data recovery readiness.

Get a 45-day free trial - no hidden terms.

Bryt Software provides a comprehensive, cloud-native lending software solution tailored for consumer lending companies. It streamlines loan management, enhances security, and offers customizable loan solutions.

Bryt Software employs Two-Factor Authentication (2FA), Azure SQL for data storage, and robust contingency plans. Our security measures exceed industry standards, protecting your data at every level.

BrytSoftware is highly customizable, empowering you to tailor the software to your specific project-specific loans and business requirements.

Bryt Software stores data securely in Azure SQL with features like point-in-time restore and redundancy. Files are stored in Azure Blob storage with redundancy and high availability.

Data recovery testing occurs at least every other week. Cloud-hosted databases are restored to local machines, ensuring data recovery readiness in emergencies.

Bryt Software empowers you to streamline operations, enhance security, and innovate in lending, ensuring your journey stays on the path of success in the ever-evolving lending landscape.

© 2024 Bryt Software LCC. All Rights Reserved.