Amplify Micro Loans’ ROI With Cloud-Native Solution

Automate workflows and drive 4X efficiency with Bryt's Advanced Microfinance Management System

Automate workflows and drive 4X efficiency with Bryt's Advanced Microfinance Management System

Turn the forecast into an infinite growth potential with 2X precision

Start Your Bryt Journey NowFast-track your success with Bryt. Automate, focus, and watch your growth skyrocket.

Get Your 45-Day Free Trial

In the dynamic microfinance landscape, scaling isn't just a goal – it's a necessity. With Bryt at your service, scalability transforms into a seamless journey, allowing your lending operations to expand in sync with the market's pulse.

Solid risk management is the cornerstone of a robust loan portfolio. Enter Bryt – your partner in dynamic risk analysis. Navigate potential challenges with foresight, optimizing lending strategies for enduring success in both Bryt's innovative world and the microfinance realm.

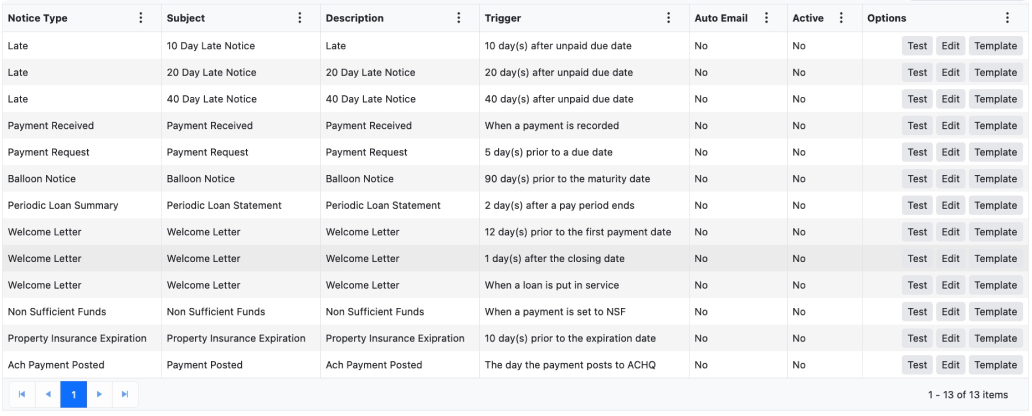

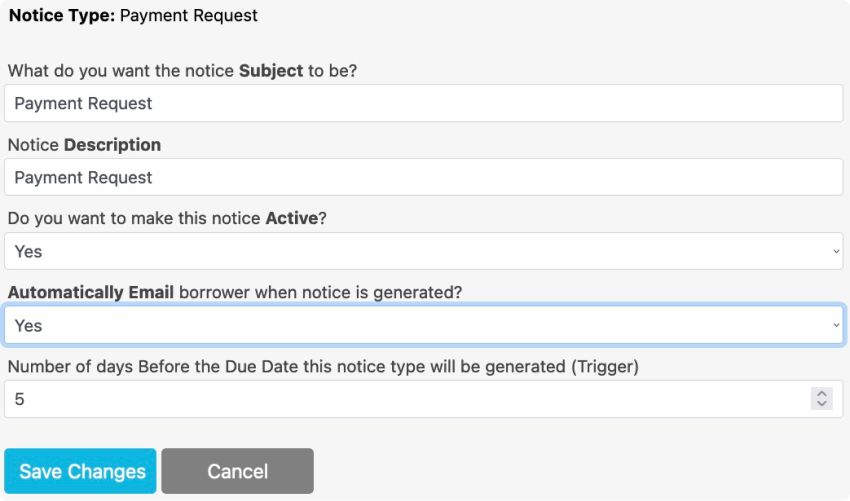

Bryt’s pre-built notices, reminders, and summaries ensure smooth client communication. Personalized and automated, our notices ease your communication woes.

Bryt Software doesn't just provide a lending solution – it offers a partnership. Get unlimited, comprehensive support via guides, videos, chat, and more. Rest easy with Microsoft Azure Cloud's top-tier security.

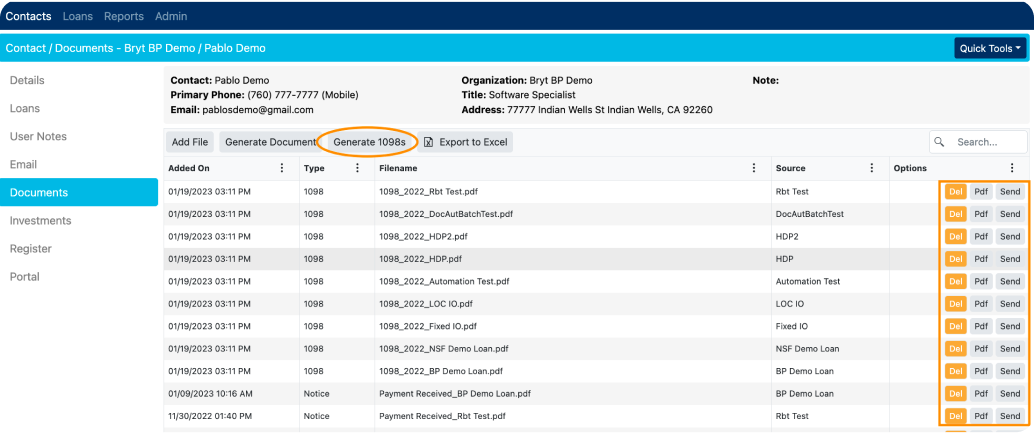

Bryt Software ensures crystal-clear audit trails and transparent records with IRS-compliant 1098 reports. Now level up your compliance game easily. Bryt Software's automated batch communication feature helps you streamline your borrower interaction. Download notices and documents effortlessly, ensuring consistent communication.

Automate data collection and underwriting for future-proof decisions for pay-day loans. Bryt Software’s insights into borrowers’ financial history ensure confident approvals. Customize loan structures for each borrower, reduce risk, and make informed decisions. Bryt helps you tackle delinquency head-on.

Bryt's automated emails redefine communication. Stay in sync with borrowers effortlessly.

Get Started Now!

Bryt's API integration prowess offers unified lending. Seamlessly integrate third-party solutions, fostering growth and success in one platform.

Break free from generic payment plans. With Bryt, you can tailor payment frequencies for a unique lending experience—weekly, bi-weekly… You name it. Customize welcome letters, ACH authorization templates, and much more.

Managing insurance for asset-defined lending has never been this easy. Bryt's ‘Asset and Insurance Tracking’ module streamlines information sharing, empowers collateral management, and ensures compliance. Efficient insurance management, your way.

Your data deserves the best. Bryt employs top-tier security standards, encrypting client data on the Azure cloud. Microsoft Cloud's advanced protection ensures optimum privacy and infrastructural and operational security.

Experience 100% system up-time with our cloud-native lending solution. Manage loans effortlessly, with scalability for lenders, and guarantee a seamless experience for borrowers. Simple yet powerful.

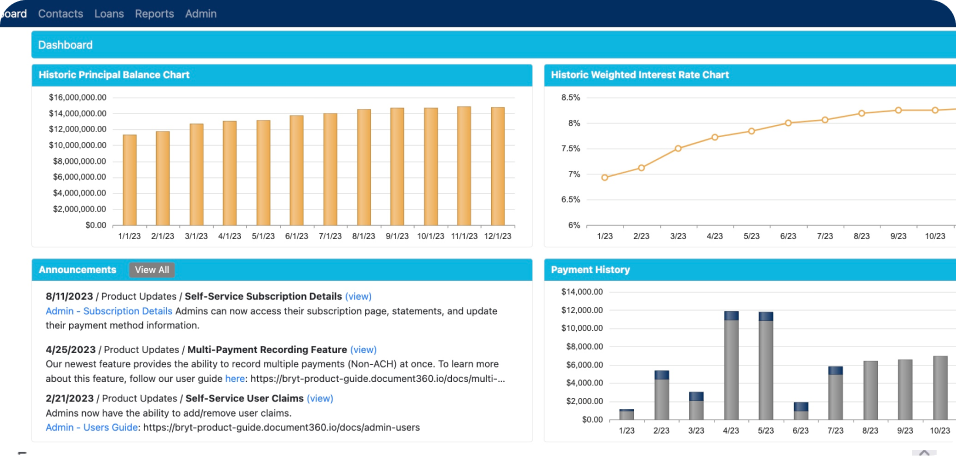

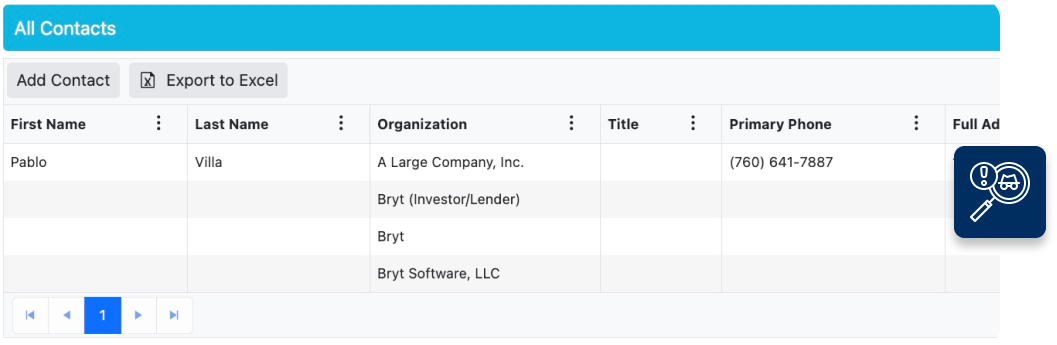

Need contact details, loan status, or payment history? It's all at your fingertips with Bryt Software. Swift loan initiation, panoramic loan views, and targeted insights - just a click away.

Seamless borrower payments, holistic financial management, targeted insights - Bryt empowers every step.

Schedule a Discovery Call TodayBryt Software allows you to automate a range of documents, including welcome letters, amortization schedules, ACH authorization forms, Statement-H 30(A) Loan Summary invoices, and more, tailored to your specific business needs.

With Bryt microfinance loan management software, you have the flexibility to tailor payment frequencies according to your borrowers’ preferences. Whatever your payment frequency is, you can create a lending experience that stands out.

Bryt’s module streamlines information sharing for asset-defined lending programs. It empowers lenders by helping them identify under-collateralization, ensuring compliance with regulations, and efficiently managing insurance policies.

Your data’s security is paramount. Bryt Software encrypts all client data and personal information on the Azure cloud computing platform. We rely on Microsoft Cloud’s advanced threat protection to ensure data privacy and security.

Bryt Software offers a cloud-native lending solution that caters to both lenders and borrowers. Lenders benefit from scalability, while borrowers enjoy an easy and efficient loan management experience on the go.

Bryt’s API integration empowers your business with seamless third-party integration, creating a unified lending platform. This integration fosters an environment of growth and success by streamlining operations and enhancing efficiency.

© 2024 Bryt Software LCC. All Rights Reserved.