Empower Non-Profits With Flexible Financing Solutions

Deliver loans tailored to their unique needs with Bryt’s full-suite lending solution.

Deliver loans tailored to their unique needs with Bryt’s full-suite lending solution.

With Bryt’s customizable loan structures that empower you to curate inclusive loan programs minus the time-suck.

Get Started Now!

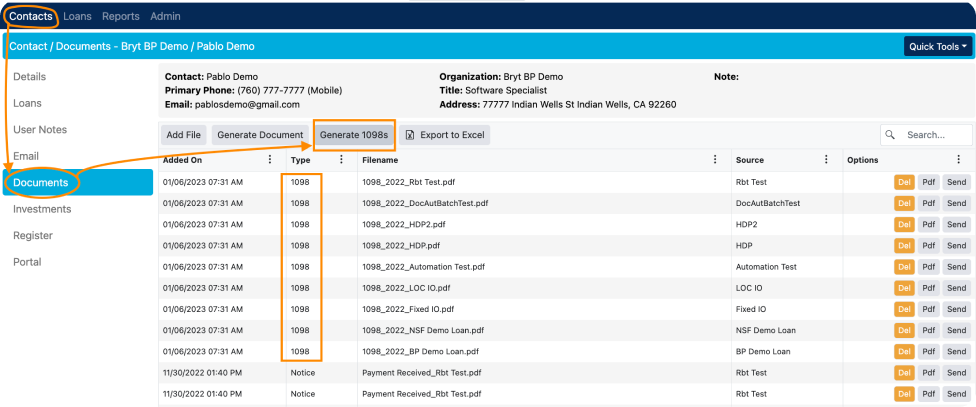

Simplify tax reporting with the 1098 and 1099 batch creation. Access essential reports, such as the Payment Register and Consolidated Payments, and keep track of insurance policies, with reminders for critical events like policy expiration and payments with Bryt.

Efficiently manage collateral and insurance policies to mitigate risk effectively. Accurately calculate and allocate fees to investors or servicers, enhancing financial transparency.

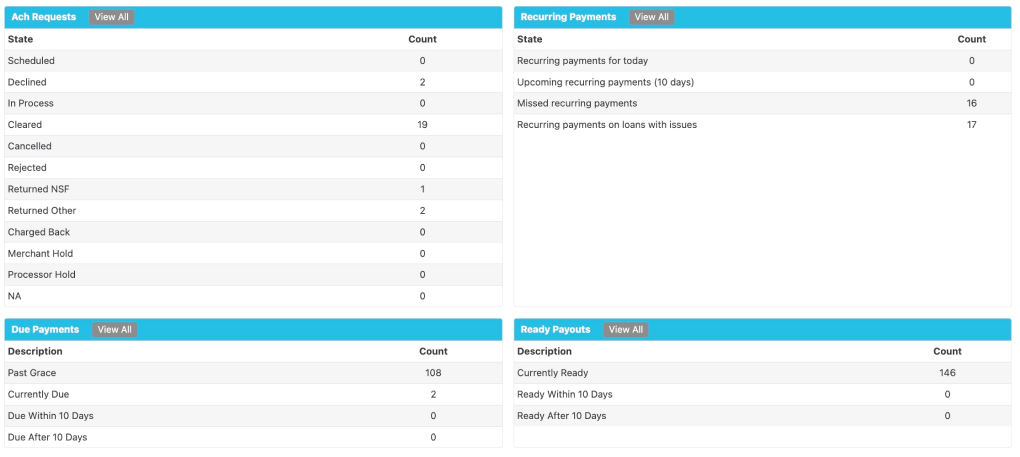

Streamline recurring payments and ACH processing with the ACH/Recurring Pay-ins module. This is a feature specifically set up to help lenders consolidate their expected payments across all loans, to easier identify dues via ACH.

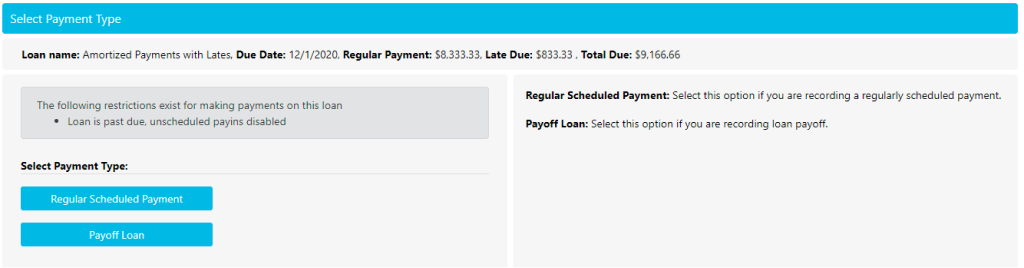

With Bryt Software, say goodbye to the hassle of paperwork and redundant processes. Our intuitive loan management software streamlines operations, saving you time and effort. Enjoy timely updates, reduce waiting times, and eliminate delays hindering your financial growth.

Stay on top of collateral information and insurance policies, with automated reminders for critical events such as policy expiration and payments, safeguarding your non-profit's assets. Accurately calculate and allocate fees to investors or servicers with precision, enhancing financial transparency and accountability within your organization.

With our transparent pricing, there are no hidden fees or surprise charges. What you see is what you get, allowing you to plan your finances with confidence. Bryt’s pricing system offers flexibility, allowing you to tailor your software package to match your specific requirements—no more compromises due to budget constraints.

Bryt Software leverages the Microsoft Cloud's remarkable 99.95% availability. Your loan management system remains accessible and reliable, ensuring uninterrupted operations when you need them most. The Microsoft Azure Security Center provides unified security management and advanced threat protection across the cloud. Your data is safeguarded at every level, giving you peace of mind.

Microsoft Azure's scalability allows Bryt Software to compute power effortlessly. With just a click of a button, we can adjust our infrastructure to meet your evolving needs. With Bryt Software, you're not just getting today's solutions but a future-ready system that can adapt and grow alongside your organization.

We ensure your lending journey stays on the path of success.

Schedule Your DemoYes, absolutely. Bryt Software‘s email and notice features allow non-profits to automate communication, ensuring borrowers and donors receive timely updates and acknowledgments related to loans and contributions.

A 99.95% availability rate means that the loan management system is accessible and reliable most of the time. Bryt Software achieves this through its partnership with Microsoft Azure, which provides high availability. For more information, get in touch with us at sales@brytsoftware.com or (+1) 760 895 4031.

Bryt Software‘s partnership with the Microsoft Cloud offers non-profit organizations a secure, reliable, and scalable loan management solution. It ensures that loan management remains efficient and protected, supporting non-profits’ mission-critical operations.

Yes, Bryt Software’s loan management solutions are designed to be flexible and adaptable. They can be customized to meet non-profit organizations’ specific requirements and objectives, ensuring efficient loan management.

The Microsoft Cloud provides extensive compliance coverage. Bryt Software benefits from Microsoft’s commitment to compliance, which includes adherence to various industry-specific regulations and standards, ensuring data integrity, and legal compliance in loan management.

© 2024 Bryt Software LCC. All Rights Reserved.