Save Time & Resources in Education Loan Management

Experience seamless, paperless, and comprehensive loan management cloud solutions. Bryt relentlessly focuses on efficiency, innovation, and success.

Experience seamless, paperless, and comprehensive loan management cloud solutions. Bryt relentlessly focuses on efficiency, innovation, and success.

Streamline workflow with Bryt. Scale in the booming landscape.

Get Started Now!

Quickly create new loan offerings, minimizing risk and maximizing efficiency

Start 45-Day Free TrialGet a 45-day free trial - no hidden terms.

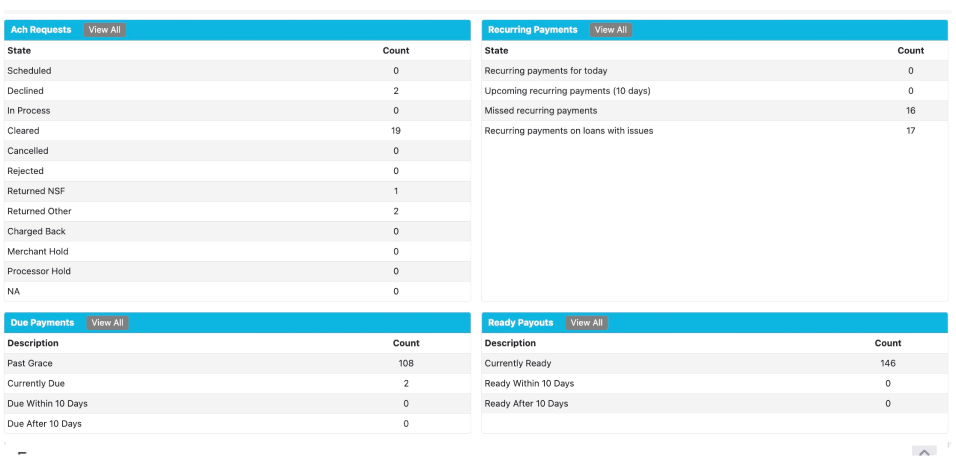

With Bryt's ACH Module, you can simplify the process of authorized one-off or recurring ACH transactions, all while ensuring the utmost security. Tailor options for completing the work to the skill of the user.

For those seeking enhanced fund management, the NACHA add-on module is a game-changer. Generate NACHA files to draw funds from borrower accounts and facilitate payouts effortlessly. Take control of your financial operations like never before.

Bryt puts you in the driver's seat of your financial management through custom-made Register Accounts. Head to the Admin tab to access 'Register Accounts,' where default and custom account types await your discovery.

Switch to the Loan tab and witness the Register in full swing. Dive into loan-specific details, unveiling a comprehensive view of Credits and Debits. Here, your financial landscape comes to life, giving you the insight you need to make informed decisions.

Bryt's modules redefine loan management by providing you with tools for customization, efficiency, and security.

Book a One-on-One ConsultationWith Bryt's ACH Module, you can simplify the process of authorized one-off or recurring ACH transactions, all while ensuring the utmost security. Tailor options for completing the work to the skill of the user.

For those seeking enhanced fund management, the NACHA add-on module is a game-changer. Generate NACHA files to draw funds from borrower accounts and facilitate payouts effortlessly. Take control of your financial operations like never before.

Bryt puts you in the driver's seat of your financial management through custom-made Register Accounts. Head to the Admin tab to access 'Register Accounts,' where default and custom account types await your discovery.

Switch to the Loan tab and witness the Register in full swing. Dive into loan-specific details, unveiling a comprehensive view of Credits and Debits. Here, your financial landscape comes to life, giving you the insight you need to make informed decisions.

Bryt's modules redefine loan management by providing you with tools for customization, efficiency, and security.

Get Your Free Trial

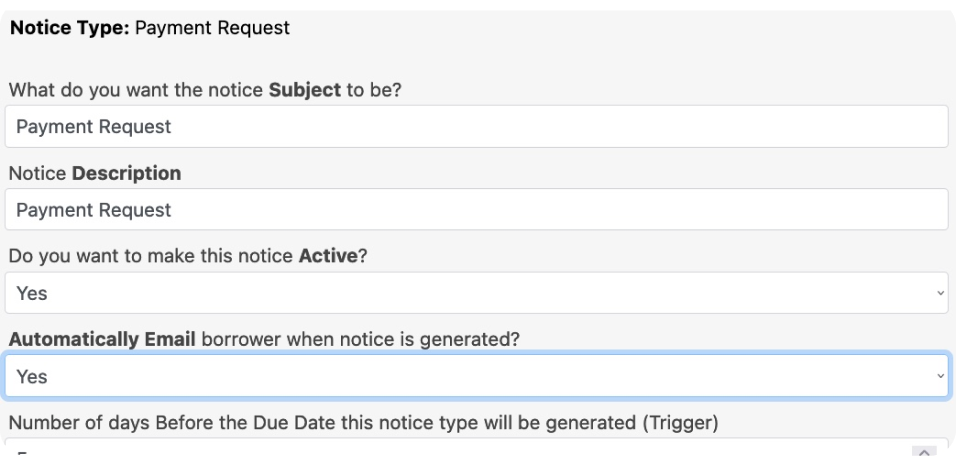

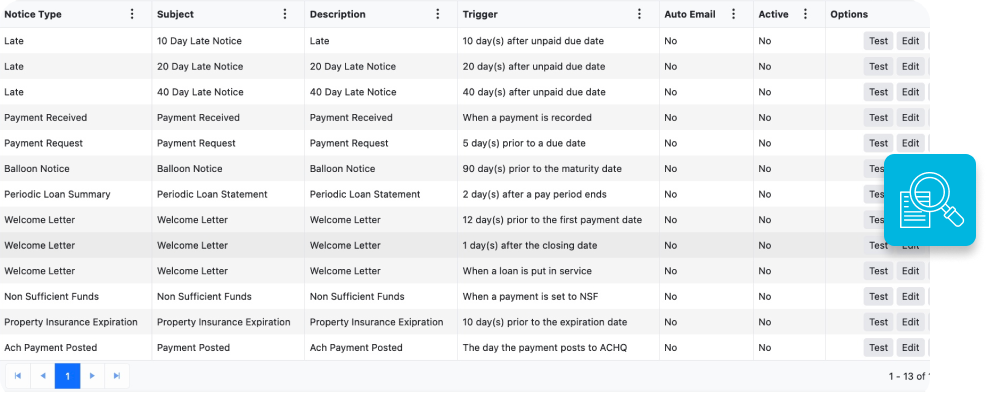

Bid farewell to manual notices and late payment concerns. Bryt Software's comprehensive system comes packed with pre-populated standard notices, making communication a breeze. Stay informed with real-time views of queued and sent notices through our user-friendly dashboard.

Experience a solution that speaks your language. Bryt Software is meticulously designed by industry experts with decades of executive experience in the lending realm. From loan processing and assessment to servicing and collections management, our software covers every step of the loan lifecycle.

Bryt’s user-friendly dashboard and administrative features empower your team to work seamlessly, from customized email communication to user details management. Keep everyone informed, engaged, and aligned.

No more restrictive contracts or hidden fees, no Set-up or Implementation Fees. At Bryt Software, transparency is at the core of our ethos. Our pricing is straightforward, enabling you to focus on what truly matters – your lending operations. It's a commitment to simplicity that sets us apart.

Register Accounts in Bryt Software are customizable financial categories that allow you to track and manage various financial transactions, such as income, expenses, and other financial activities. They enhance your financial management by providing a structured way to organize and analyze your financial data, enabling better decision-making and insights into your financial health.

You can customize Register Accounts in the ‘Admin’ tab of Bryt Software. By accessing the ‘Register Accounts’ section, you can create, modify, or delete default and custom account types. This customization empowers you to tailor your financial tracking to match your unique business or personal requirements.

Our Asset and Insurance Tracking Module helps you manage collateral effectively, reducing the risk of under-collateralized loans. Stay compliant with regulations while safeguarding your lending portfolio with this student loan servicing software.

Yes, you can. Bryt’s API Module enables seamless integration with your existing systems, third-party services, and applications. This integration enhances data flow, reduces duplication, and maximizes the efficiency of your operations.

Transitioning between amortization and fixed payments involves adjusting the payment structure of a loan. Bryt Software simplifies this process, enabling you to switch between these payment methods seamlessly. Whether you’re adapting to market shifts or refining your lending strategy, Bryt Software facilitates these transitions effortlessly.

To optimize your financial management using Register Accounts and the Loan Register in Bryt Software, consider these best practices: regularly review and reconcile your financial data, use customized account types to accurately categorize transactions, leverage the Loan Register for detailed loan-specific insights, and make use of the pay period adjustment feature to adapt to changing circumstances effectively.

© 2024 Bryt Software LCC. All Rights Reserved.