Unify Workflows for Franchise Financing with Bryt

Leverage seamless integration and bring innovation to the forefront of your lending operations

Leverage seamless integration and bring innovation to the forefront of your lending operations

Step into 30.2% CAGR & $670B market industry with Bryt’s targeted solution

Get Started Now!Transform data into dollars. Be a part of the global CAGR surge.

See Bryt in Action

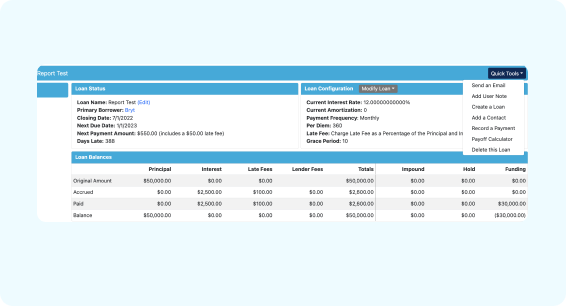

Effortlessly manage transactions, accounting summaries, and aggregated interest through Bryt's intuitive interface. Real-time data visibility ensures you're always in control. You can even automate the creation and emailing of templates to borrowers associated with the loan.

Minimize operational costs and simplify loan management with Bryt Software's seamless automated batching. Handle larger workloads, enhance efficiency, and elevate the borrower experience.

Bid farewell to complex loan management processes. Bryt Software's Loan Creation Wizard automates day-to-day loan servicing tasks. Easily track payments, accruals, write-offs, and so much more at just a glance.

Bryt Software empowers you to manage unlimited contacts for all your loans, fostering better borrower relationships. Upload and store essential documents, notes, and files to resolve complex loan issues faster.

Drive ROI with efficient interest accrual methods. Bryt Software offers flexibility by accommodating standard accrual methods such as 30/360, Actual/365, and Actual/360. You can adjust Payment Frequency, Per Diem, and Interest Day-Count to suit your specific lending requirements.

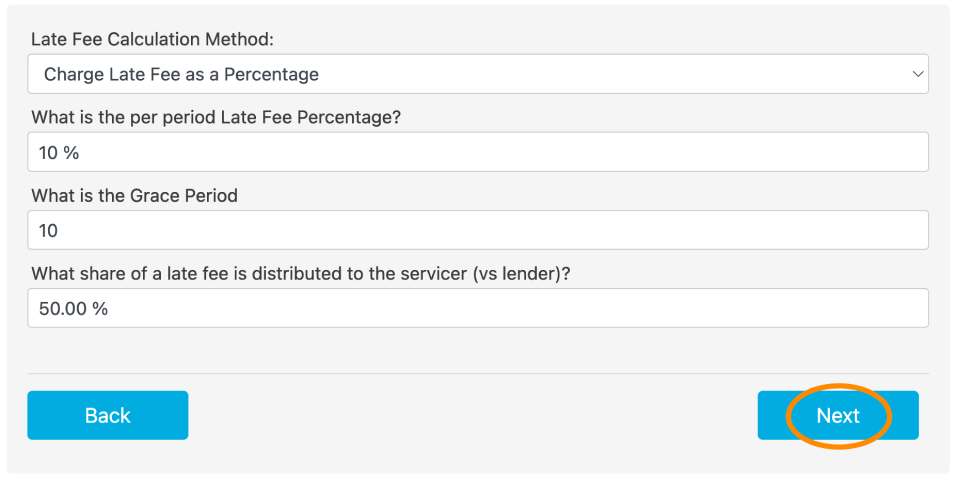

Maximize income collection with automated late fee calculations—Bryt Software streamlines late fee processing based on various factors, ensuring optimal profitability.

Bryt’s products and services are hosted using Azure's Premium V2 App Service, backed by a 99.95% Service Level Agreement (SLA) Uptime Guarantee. This ensures consistent and uninterrupted access to our solutions.

Bryt Software is designed with simplicity in mind. It has an intuitive interface that requires minimal training for effective navigation and utilization. A key strategy Bryt employs to ensure ease of use is the standardization of features and functionality throughout the website.

Navigate the platform seamlessly with Quick Tools that provide direct access to frequently used sections, reducing time spent searching for specific features. Quick Tools expedite your workflow, saving you valuable time and allowing you to focus on more strategic activities.

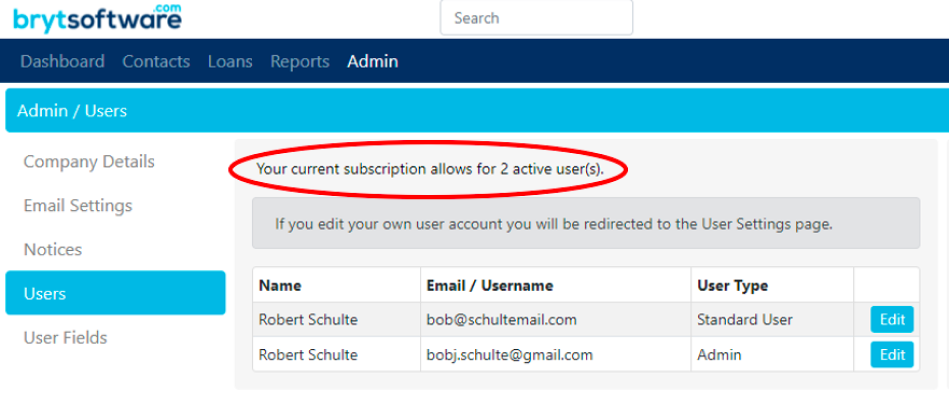

Bryt understands the importance of data security and confidentiality. Customizable access levels enable you to assign precise permissions to each user. Individuals can only access the information and features relevant to their roles, minimizing the risk of unauthorized data exposure.

The core Bryt system is designed for self-implementation, requiring minimal to no assistance from our support team. While advanced features and modules might need some support, our user-friendly setup ensures a smooth process.

Bryt’s standard Support Options come at no additional cost. Whether you're on a free trial or a paid subscription, its support is readily available to assist you every step of the way. The comprehensive support options cater to various learning styles and preferences, allowing you to make the most of the Bryt system.

Bryt Software‘s solution allows you to create customized repayment plans that align with your borrower’s cash flow and income. Our automated loan reporting streamlines borrower data, making customization effortless.

Bryt Software enables risk-appropriate decisions by helping you structure loans to cater to each borrower’s unique needs. You can introduce additional collateral or adjust interest rates based on data-driven insights.

Bryt Software‘s solution generates comprehensive loan reports, payment schedules, and balances. You can ensure smooth and accurate communication with borrowers with automated notices and templates.

Bryt Software‘s automated batching, workflow automation and CRM feature enhances operational efficiency. It helps you handle larger workloads seamlessly, leading to improved borrower experiences and streamlined processes.

Bryt Software’s Loan Creation Wizard automates loan servicing tasks like payment tracking, accruals, and communication. The advanced loan tracker empowers you with data-driven insights to help you make informed decisions.

Security is paramount. Bryt Software employs data encryption, and our system is built on Microsoft Cloud’s secure Azure platform. So, your data’s integrity and privacy are ensured through Microsoft’s advanced threat protection measures.

© 2024 Bryt Software LCC. All Rights Reserved.