Enhance Compliance in Municipal Loan Management System with Bryt

Leverage automation, transparent reporting and cloud efficacy with Bryt’s industry-specific expertise

Leverage automation, transparent reporting and cloud efficacy with Bryt’s industry-specific expertise

Understand market trends and data and manage debt efficiently with Bryt’s comprehensive loan management suite

Get Started Now!Opt for reliable and consistent loan management with a Business Continuity Plan

Start your Bryt Journey

Bryt prioritizes your data's integrity through advanced features like Azure Point-In-Time Restore, enabling us to revert a database to a previous state within 35 days. Redundancy is ingrained in our approach as all databases reside in Azure's US data center, reinforcing data security and availability.

Should an administrator inadvertently affect customer data, Azure's point-in-time restore capabilities become our safeguard. Bryt restores data to a known, error-free state, ensuring minimal disruptions.

Bryt upholds data recovery by regularly restoring cloud-hosted databases to local machines. Rigorous testing using a local copy of the Bryt Application assures data integrity.

Bryt Software's application resides within the Azure DevOps system. Our incremental code changes and development branches are meticulously stored. Updates undergo rigorous testing on staging servers before deployment to the production server, ensuring uninterrupted application functionality.

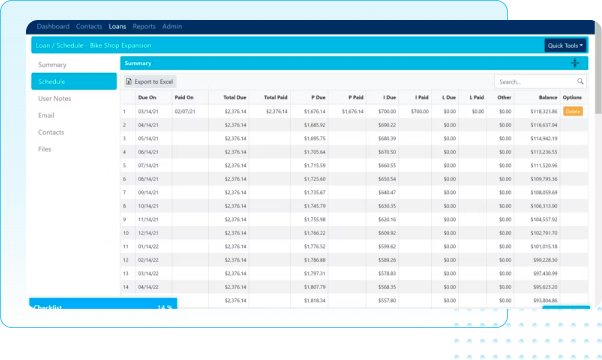

Simplify debt tracking and transparency in the entire loan lifecycle with Bryt

Schedule Your Demo

Closing dates and payment frequencies don't always align perfectly. Bryt Software calculates and manages prorated payments with ease, ensuring accuracy and minimizing confusion.

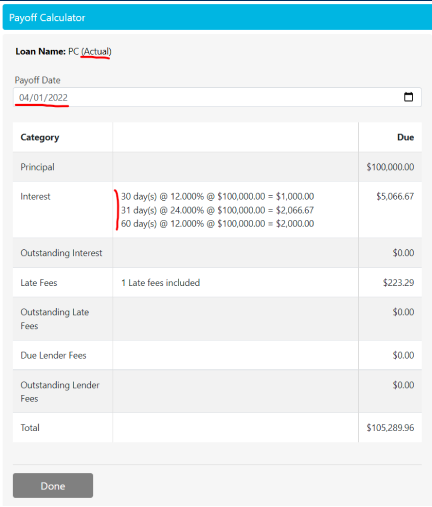

Bryt’s payoff calculator simplifies the process of determining borrower obligations for a selected payoff date. Itemized breakdowns help both lenders and borrowers understand the financial landscape better.

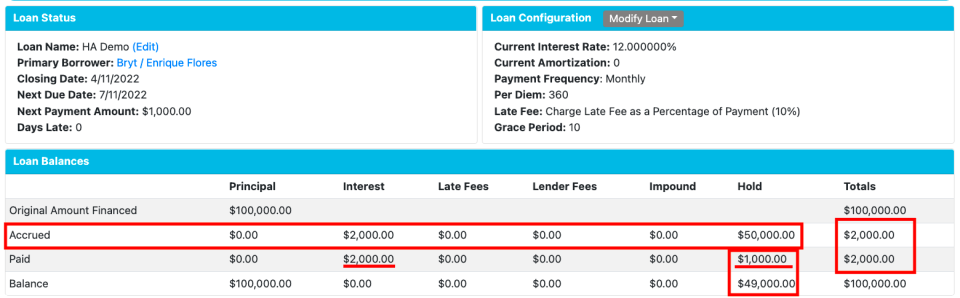

Managing overpaid amounts or holding funds for future payments is super easy with our “Hold Account” functionality. It's like an interest reserve tailored to your needs.

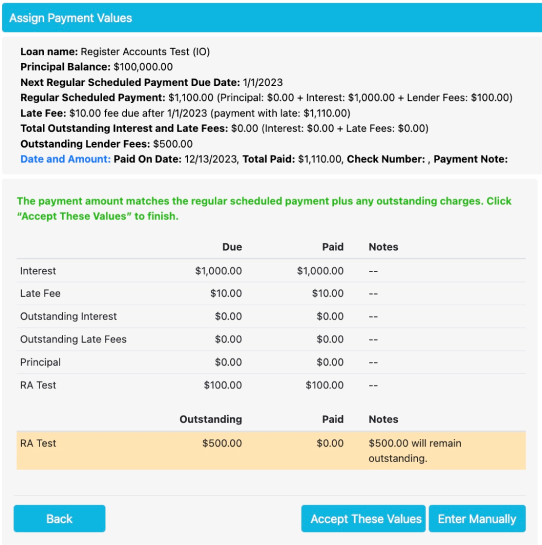

Navigating complex tasks has never been easier. Bryt Software's Process Wizards simplify intricate functions by providing step-by-step guidance. Whether it's creating a loan or recording payments, these user-friendly interfaces ensure accuracy and efficiency.

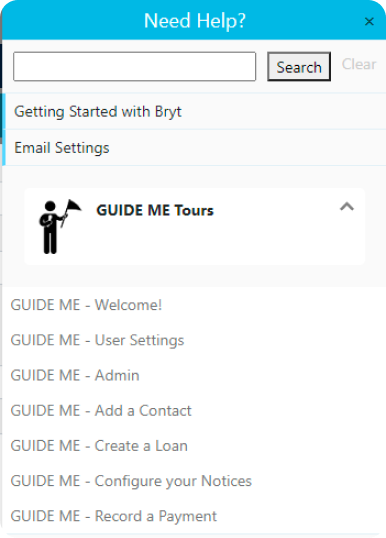

Bryt’s GUIDE ME Tours is a unique feature designed to assist users in implementing new features seamlessly. Whether you're a novice or a seasoned user, the interactive walk-throughs offer hands-on guidance, enabling you to harness the full potential of Bryt Software's capabilities.

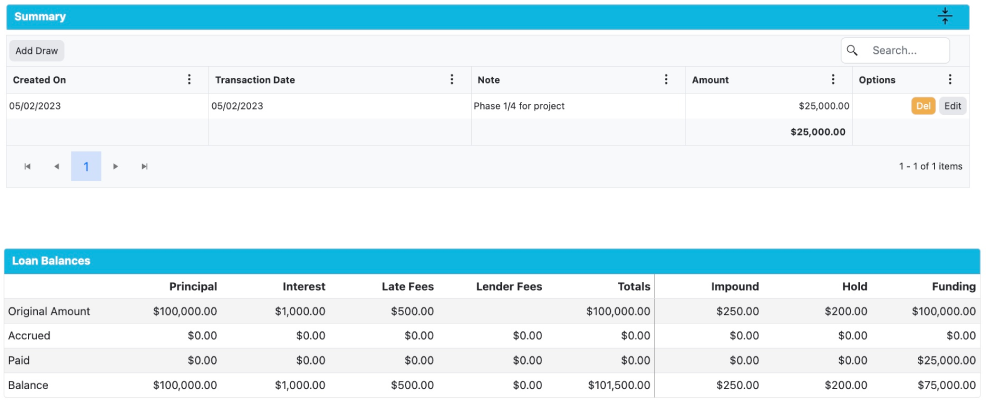

Managing funding is no longer a challenge with Draws, our integrated funding control feature. Unlike conventional systems, Bryt Software's innovative approach ensures interest is calculated only on the disbursed amount. This powerful tool lets you segment and track funding for borrower projects, mitigate risks, and ensure projects are completed within timelines.

Seamless Implementation and Azure's Resilience Boosting ROI 5X

Schedule a DemoThe Borrower Portal is a feature that empowers borrowers to manage their loans efficiently. It allows them to make payments, view payment history, adjust settings, and even update personal information. This feature brings convenience and control to borrowers while simplifying interactions with lenders.

Bryt Software’s funding control, known as Draws, provides a mechanism to manage cash flows and disbursements. It ensures that interest is charged only on the disbursed amount, offering precise financial management. It’s a powerful tool for those looking to track and segment project funding, mitigate risks, and meet completion deadlines.

Process Wizards are user interfaces that guide users through complex tasks step by step. They present a sequence of dialog boxes or questions that lead users through well-defined steps. From creating a loan to recording payments, Process Wizards enhance accuracy and efficiency, making intricate tasks more manageable.

Point-In-Time Restore allows databases to be restored to a previous state within a specific time frame. This feature is crucial for recovering from data-related issues caused by various factors. It ensures that data integrity is maintained by enabling a rollback to a known good state.

Bryt Software’s application is regularly updated, with changes to code and development branches stored incrementally. Updates are carefully tested on staging servers before being deployed to the production server. This approach ensures the application remains robust and reliable, enhancing the user experience.

The primary hosting operations region for Bryt Software’s products and services is the US West. Leveraging Azure’s Premium V2 App Service, we offer an industry-standard 99.95% Service Level Agreement (SLA) Uptime Guarantee, ensuring a reliable and consistent user experience.

© 2024 Bryt Software LCC. All Rights Reserved.