An Ultimate Guide to Customize Loan Documents for Different Types of Loans

In lending, one size does not fit all. Different types of loans have unique requirements, and the documents associated with them must be tailored to meet these specific needs. Customizing loan documents not only ensures compliance with regulations but also improves clarity and transparency for borrowers.

In this guide, we’ll explore the importance of customizing loan documents, the types of loans that require customization, key components to consider, tools and software available, best practices, compliance considerations, and future trends in loan document customization.

Customizing loan documents is a crucial step in the lending process, offering benefits for both lenders and borrowers. Here are some key reasons why customizing loan documents is important:

Different types of loans have unique requirements, such as varying repayment terms, interest rates, and collateral requirements. Customizing loan documents ensures that these specific requirements are accurately reflected in the documents, reducing the risk of misunderstandings between lenders and borrowers.

Customizing loan documents helps ensure that lenders comply with relevant laws and regulations governing lending practices. Failure to comply with these regulations can result in legal consequences, such as fines or penalties.

Customized loan documents are easier for borrowers to understand, as they clearly outline the terms and conditions of the loan. This transparency can help build trust between lenders and borrowers and reduce the likelihood of disputes.

By customizing loan documents to meet the specific needs of borrowers, lenders can enhance the overall borrower experience. Clear and transparent loan documents can help borrowers feel more confident in their decision to borrow money and can streamline the loan approval process.

Customizing loan documents can help reduce the risk of default by ensuring that borrowers clearly understand their obligations under the loan agreement. Clear documentation can also make it easier for lenders to enforce the terms of the loan in the event of default.

Let’s check out some common types of loans and the type of customization typically required for each:

When customizing loan documents for mortgage loans, it’s important to include specifics about the property being financed, such as its legal description, appraised value, and any liens or encumbrances. Additionally, the loan documents should outline the loan amount, interest rate, repayment term (e.g., 30-year fixed-rate), and any escrow requirements for taxes and insurance.

For personal loans, customization of loan documents should include the loan amount, interest rate, and repayment terms, along with any fees or penalties that may apply. The documents should also specify any collateral that may be required to secure the loan, as well as any co-signers or guarantors.

Customizing loan documents for business loans involves detailing the purpose of the loan, the amount being borrowed, the interest rate, and the repayment terms. Additionally, the documents should outline any collateral being used to secure the loan, as well as any personal guarantees from the business owners or directors.

Auto loan documents should include details about the vehicle being financed, such as its make, model, year, and Vehicle Identification Number (VIN). The documents should also specify the loan amount, interest rate, and repayment terms, as well as any requirements for comprehensive insurance coverage on the vehicle.

When customizing loan documents for student loans, it’s important to include details about the student borrower, such as their enrollment status, academic program, and expected graduation date. The documents should also outline the loan amount, interest rate, and repayment terms, as well as any deferment or forbearance options available to the borrower.

For B2B manufacturing loans, customization of loan documents should include details about the manufacturing business, such as its industry, annual revenue, and financial statements. The documents should also specify the loan amount, interest rate, and repayment terms, as well as any requirements for inventory or equipment financing.

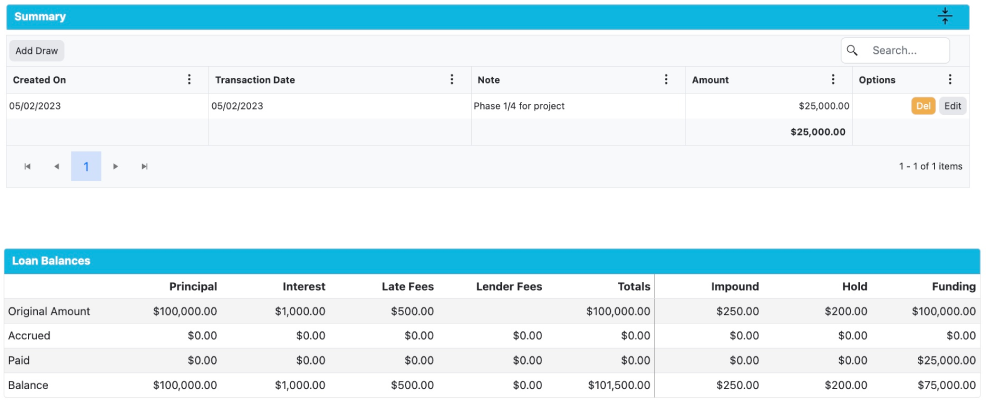

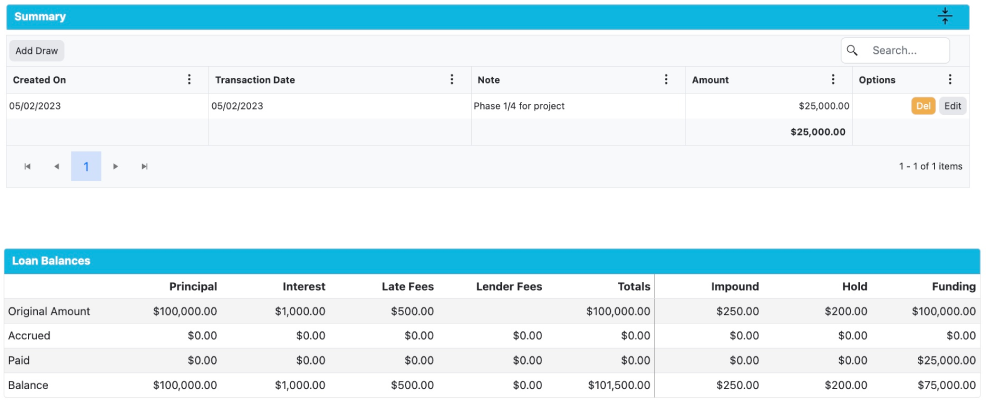

Customizing loan documents for construction loans involves detailing the construction project, including its location, scope, and timeline. The documents should also outline the loan amount, interest rate, and repayment terms, as well as any milestones or draw schedules related to the construction project.

Note: Each type of loan may require different levels of customization based on the lender’s policies and the borrower’s needs. Customizing loan documents to fit the specific requirements of each loan type can help ensure that both parties understand the terms of the loan and can help prevent misunderstandings or disputes.

When customizing loan documents, several key components should be considered:

When customizing loan documents, it’s important to follow the below mentioned best practices to ensure accuracy and compliance:

Consistency in Branding and Formatting: Maintain a consistent branding and formatting style across all loan documents.

Plain Language and Easily Understandable Terms: Use simple and easy to understand terms and to ensure that borrowers can clearly understand the terms of the loan.

Legal Review and Compliance Checks: Have legal professionals review loan documents to ensure compliance with regulations and laws.

Version Control and Document Security: Use version control to track changes to loan documents and ensure document security.

Customizing loan documents should also focus on ensuring accessibility and ease of use for borrowers:

Compliance is a critical consideration when customizing loan documents:

There are several key performance indicators (KPIs) that can be used to assess whether customized loan documents are aligned with loan requirements. This approach helps in reducing the risk of errors, improving efficiency, and enhancing the overall borrower experience.

KPIs to consider:

Custom Loan Configurations: With Bryt, you can add all sorts of custom configurations and user field modules to collect and report on different types of loan data. So, whether you’re dealing with personal loans, business loans, or anything in between, Bryt’s got you covered.

Tailored Loans for Unique Needs: Bryt lets you create repayment plans and solutions that match your borrower’s cash flow and income. This means you can deliver loans that are perfectly tailored to their unique needs.

Curated Lending Strategies: Want to analyze trends and forecast loan performance? Bryt’s got standard reports that can help you make data-backed decisions about your lending strategies.

Better Portfolio Performance: With Bryt’s robust report writer, you can monitor the performance of your loan portfolio with ease. Keep track of repayment behavior, missed payments, and other key performance indicators to stay on top of your game.

Efficient Loan Processing: Bryt’s intuitive loan reporting lets you configure loans based on your borrower’s finances. Customize loan terms, including loan amounts, interest rates, late fees, and repayment schedules, to deliver loan products that match their financial preferences.

Risk & Delinquency Management: Bryt helps you mitigate risks by curating loan structures that cater to each borrower’s unique needs. Keep track of collateral on your loans and prepare loan programs for those riskier borrowers.

With Bryt, you can maintain good relationships with your borrowers. Generate comprehensive loan reports on loan terms, payment schedules, and balances to ensure a positive borrower experience.

Keep an eye on all your transactions, accounting summaries, and aggregated interest in one place, without any downtime. Bryt’s intuitive system even lets you automatically create and email templates to your borrowers associated with the loan.

So, whether you’re looking to customize loan documents, improve your lending process, or strengthen customer relationships, Bryt has the tools and features to help you every step of the way.

Customizing loan documents is essential for meeting the unique needs of borrowers and ensuring compliance with regulations. By following best practices and using the right tools and software, lenders can enhance the borrower experience and streamline the loan origination process.

© 2024 Bryt Software LCC. All Rights Reserved.